BRENTWOOD, Tenn. — Giving at local churches is not keeping up with inflation, but pastors feel better about the economy than they did last year.

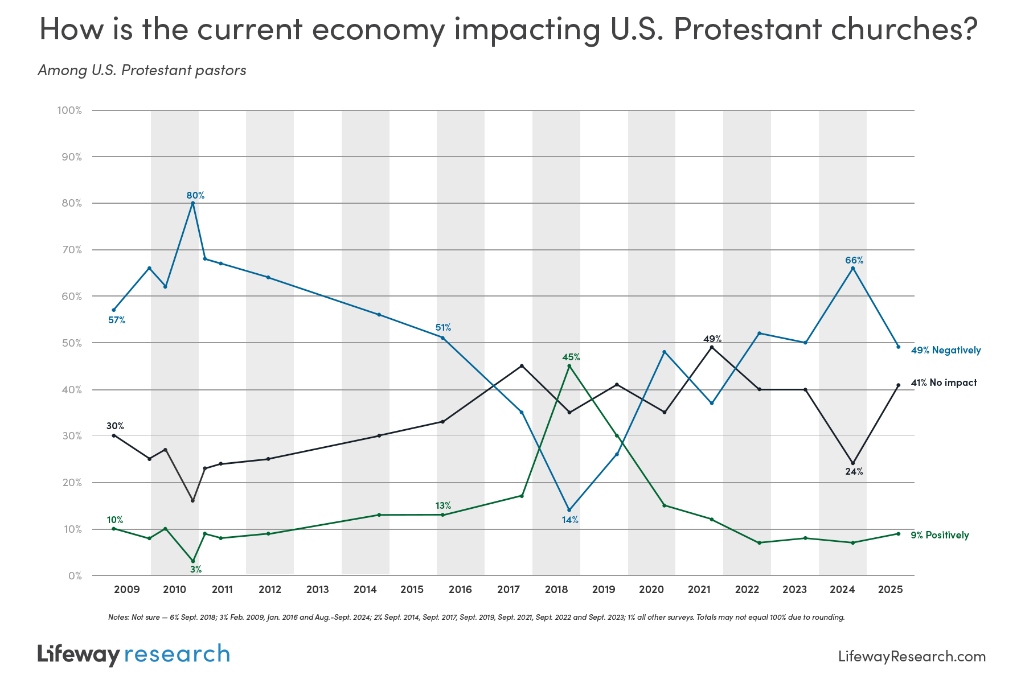

Half of U.S. Protestant pastors (49%) say the current economy is negatively impacting their churches, according to the latest tracking survey from Lifeway Research. Two in 5 (41%) don’t feel any economic impact, while 9% say the economy is a positive factor for their congregation.

“Pastors’ general impressions of the impact of the economy on their churches have noticeably improved since a year ago, but pastors are still five times more likely to be seeing negative effects as positive,” said Scott McConnell, executive director of Lifeway Research.

Economic impact

Last year, 66% of U.S. Protestant pastors felt a negative impact from the economy, the highest since 2011. Additionally, the 14% who said the effect was very negative was the highest in the 17-year study. This year’s numbers fall more in line with 2022 and 2023.

In general, pastors feel more pessimistic about how the economy affects their churches. Over the 18 studies conducted since 2009, only four times has a plurality of pastors felt the economy was not negatively impacting their congregation, including just once, in 2018, when a plurality said it was having a positive impact.

This year, pastors in certain circumstances are more likely to feel an impact. Specifically, African American pastors (63%) are the most likely to say they’re facing negative economic effects.

Those leading churches in the Northeast (58%) are more likely than those in the South (47%) to say the economy is hurting their congregations. Pastors at churches in rural areas (50%) are more likely than those in urban areas (39%) not to feel any economic impact.

Smaller and average-sized churches are feeling the brunt more than large congregations. Pastors at churches with a worship service attendance of fewer than 50 (55%) and those at churches of 50-99 (53%) are more likely than pastors of churches with 250 or more in attendance (42%) to say the economy is having a negative impact.

“Smaller churches have less ability to flex when external factors influence their finances,” McConnell said. “With a small overall budget, inflation in one ongoing expense may not be able to be met with additional giving from the small number of givers in the church.”

Mainline pastors are more likely than evangelical pastors to feel the economy is hurting their churches (55% v. 45%). Denominationally, Methodist (64%), Holiness (64%) and Presbyterian/Reformed (56%) pastors are more likely than Baptist (41%) and non-denominational (41%) pastors to see a negative impact.

Church giving

Pastors’ reduced economic pessimism does not stem from a significant increase in giving. The average church saw offering levels rise 2.1% compared to 2024. Meanwhile, inflation grew 2.9%.

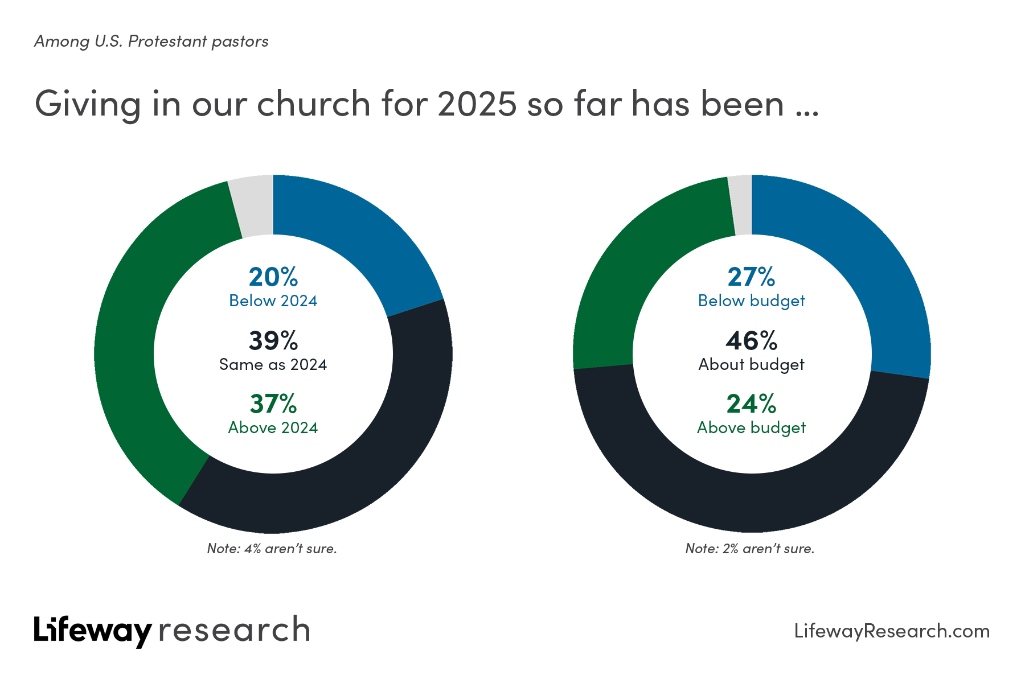

In fact, only slightly more than a third of U.S. Protestant churches (37%) saw any increase in giving over last year. Almost 2 in 5 (39%) say their levels are the same as 2024, while 20% say their offerings are down.

Specifically, 20% grew giving by less than 10% over 2024, 14% increased by 10%-24%, and 5% jumped by 25% or more. On the other end of the giving spectrum, 5% saw offerings fall by less than 10%, 10% dropped by 10%-24%, and 2% fell by 25% or more.

“The percentage of churches seeing growth in offerings matches the average of all the years surveyed, but it has been seven years (2017) since the percentage of churches with declining offerings was at 20% or less,” said McConnell. “One in five churches contracting financially is still a large number who are facing difficult financial decisions.”

Many of the same types of churches that reported feeling more of an economic pinch are also among those that say giving is down.

African American pastors (33%) are more likely than white pastors (19%) to say this year’s offering is below 2024’s. Also, pastors at churches with attendance of fewer than 50 (29%) and 50-99 (23%) are more likely than those at congregations of 250 or more (12%) to say giving is down. Pastors at the largest churches (53%) are also most likely to say their offering is above last year’s.

Giving levels among some church demographics don’t mirror their reported economic impact. Pastors in the Northeast (43%) and West (41%) are more likely than those in the Midwest (31%) to say giving is up compared to 2024. Denominationally, non-denominational (44%), Lutheran (39%) and Presbyterian/Reformed (39%) pastors are more likely than Methodists (27%) to report an increase in offerings.

Budget numbers

Almost half of U.S. Protestant pastors (46%) say their giving levels were about what they budgeted for 2025. More than a quarter (27%) report lower than budgeted giving, while 24% say they collected more than what they budgeted for the year.

“The financial pessimism that was common a year ago may have led to more conservative budgeting for some this year. More pastors report exceeding budget in 2025 than 2024 (24% v. 16%),” said McConnell. “The negative outlook in 2024 could have been influenced by post-COVID inflation or sentiments influenced by election debates.”

Again, African American pastors (41%) are more likely than white pastors (26%) to say giving is below budget.

Pastors at churches with attendance of fewer than 50 (34%) and 50-99 (29%) are more likely than churches of 250 or more (20%) to report giving that doesn’t meet their budget. Pastors at the largest churches (39%) are the most likely to say giving exceeded the budget.

Holiness pastors (39%) and Methodists (37%) are more likely than Baptist (26%), non-denominational (24%) and Presbyterian/Reformed (21%) pastors to say their offering so far this year is below what they planned for in their budget.

For more information, view the complete report and visit LifewayResearch.com.

Methodology

The phone survey of 1,003 Protestant pastors was conducted Sept. 2-24, 2025. The calling list was a stratified random sample, drawn from a list of all Protestant churches. Quotas were used for church size. Each interview was conducted with the senior pastor, minister or priest at the church. Responses were weighted by region and church size to more accurately reflect the population. The completed sample is 1,003 surveys. The sample provides 95% confidence that the sampling error does not exceed plus or minus 3.3%. This margin of error accounts for the effect of weighting. Margins of error are higher in subgroups.

Comparisons are also made to the following telephone surveys using probability sampling:

- 1,002 pastors conducted Nov. 5-12, 2009

- 1,000 pastors conducted March 1-9, 2010

- 1,000 pastors conducted Oct. 7-14, 2010

- 1,002 pastors conducted Jan. 17-27, 2011

- 1,000 pastors conducted May 18-25, 2011

- 1,000 pastors conducted May 23-31, 2012

- 1,000 pastors conducted Sept. 11-18, 2014

- 1,000 pastors conducted Jan. 8-22, 2016

- 1,000 pastors conducted Aug. 30 – Sept. 18, 2017

- 1,000 pastors conducted Aug.29 – Sept.11, 2018

- 1,000 pastors conducted Aug. 30 – Sept. 24, 2019

- 1,007 pastors conducted Sept. 2 – Oct. 2, 2020*

- 1,000 pastors conducted Sept. 1-29, 2021

- 1,000 pastors conducted Sept. 6-30, 2022

- 1,004 pastors conducted Aug. 29 – Sept. 20, 2023

- 1,003 pastors conducted Aug. 8 – Sept. 3, 2024

*Mixed-mode telephone and online

(EDITOR’S NOTE — Aaron Earls is a writer for LifeWay Christian Resources.)